Calateral is a decentralized finance (DeFi) protocol that allows people to lend and borrow cryptocurrencies without intermediaries like banks.

Collateral Borrow

There is a lot of Colateral dApps, AAVE, Moonwell, etc.

For this initial doc we will see AAVE because it is present in many networks.

What it does

AAVE enables users to deposit their cryptocurrency into shared "liquidity pools".

Other users can borrow from these pools, and lenders earn interest on their deposits. Borrowers pay interest, and the rates change based on how much money is available and how much is being borrowed.

No middlemen: The entire system runs on smart contracts—self-executing code on the blockchain—so there’s no need for a central authority like a bank or company to manage it.

Governance: AAVE has its own token (also called AAVE), and people who hold this token can vote on changes to the protocol, such as tweaking fees or adding new features.

Risks: While AAVE offers an innovative way to use cryptocurrency, it comes with risks. Smart contracts can have bugs that might be exploited, and the crypto market is highly volatile, meaning the value of your assets can rise or fall quickly.

In summary, AAVE is a platform where you can earn interest on your cryptocurrency by lending it out or borrow crypto by using your assets as collateral—all in a decentralized, community-driven system. Just keep in mind the risks before getting involved!

The Best Strategy for Colateral

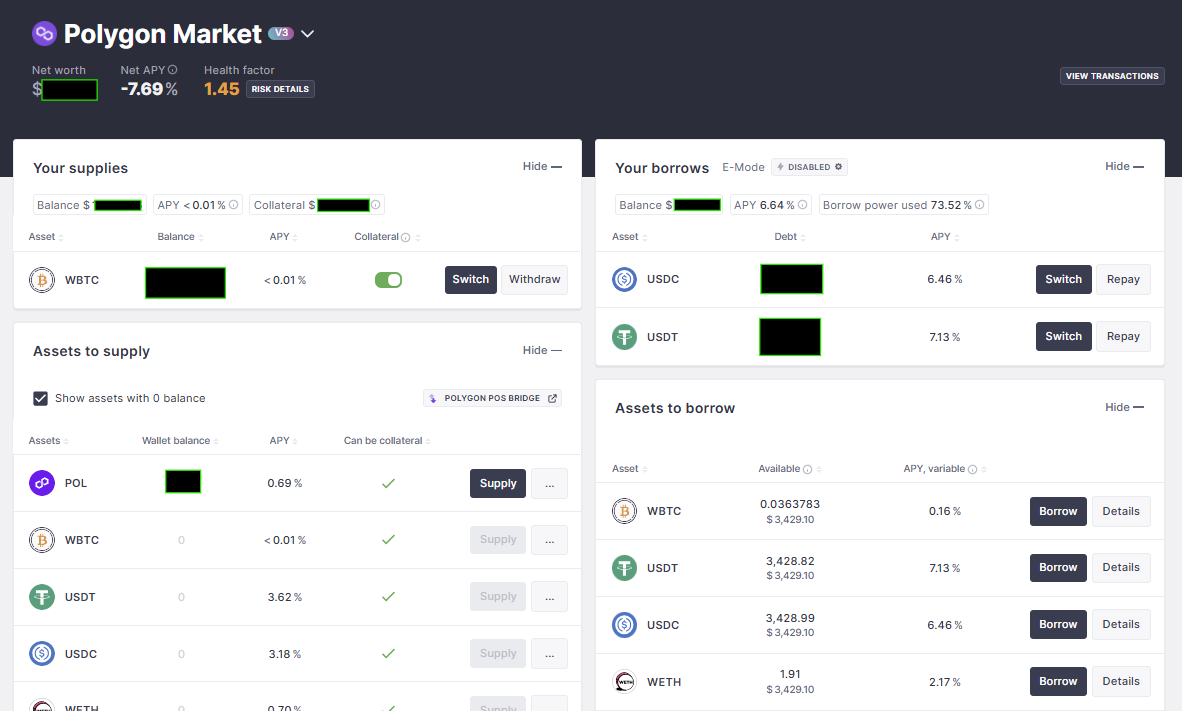

A great strategy for this dApp is changing yours tokens to wrapped Bitcoin like wBTC, LBTC, etc and deposit it as Colateral on the left side of the site. When you deposite wBTC on AAVE you can borrow 73% in other token on the right side of the site, like a stable USD like USDT or USDC.

For each token you borrow, you have a fee per year for that borrow. Sometimes you earn on your deposit too for depositing.

After you getting a borrow your account will have a Health Factor, if Bitcoin price drops, this health factor will shirink too and when reaches bellow 1.0 you will be liquided in 6,50% of all you wBTC colateral deposit. You can check it clicking over the token like here about wBTC.

But, what should be good in borrow from your money?

Think with me, if you deposit wBTC, borrow USDC you have a deposit of a token that increase the value from the begin until today. Every one knows or hear about Bitcoin price reachs U$200.000, othes said maybe U$1.000.000.

So if you deposit Bitcoin, borrow USDC you have a token that increases (deposit) and a token that always will be the same (borrowed USDC), so if you did it today with Bitcoin at U$100.000 a deposit of U$1000 in wBTC and borrow U$600 in USDC, supposing after a year, Bitcoin reachs U$200.000, you will still have U$600 borred but your wBTC valued to doble, so you will can borrow plus U$600.

That is a kind of retirement plan, you take your sallary, convert to wBTC, deposit it, borrow USDC, spend it as you will anyway. Keep doing it for some time and after 5 or 10 years, with Bitcoin price increased, you can easy retire.

-

Be careful! Bitcoin price fluctuates rapidly up and down, so always check the Health Factor to avoid liquidation. If necessary, in case of extreme price drop, you can exchange Deposit and Loan tokens.